포닥 2년 세금면제 규정

페이지 정보

작성자 최고관리자 작성일24-04-03 21:54 조회31회 댓글0건관련링크

본문

ARTICLE 20

Teachers

(1) Where a resident of one of the Contracting States is invited by the Government of the other

Contracting State, a political subdivision, or a local authority thereof, or by a university or

other recognized educational institution in that other Contracting State to come to that other

Contracting State for a period not expected to exceed 2 years for the purpose of teaching or

engaging in research, or both, at a university or other recognized educational institution and

such resident comes to that other Contracting State primarily for such purpose, his income

from personal services for teaching or research at such university or educational institution

shall be exempt from tax by that other Contracting State for a period not exceeding 2 years

from the date of his arrival in that other Contracting State.

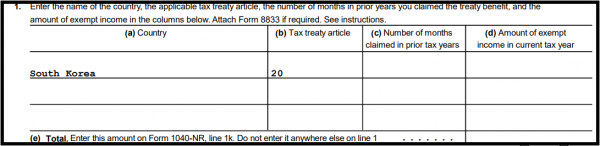

포닥의 경우 한미조세협정 20조에 따르면 "A period not exceeding 2 years from the date of his arrival"로 규정이 돼있습니다.

즉, 포닥의 업무시작일이 아닌 미국에 도착한 날을 기준으로 2년간입니다.

그래서 간혹 3년 이상의 J1 비자를 받고 미국에 입국하는 경우 포닥면제가 안되는 경우가 있으니 주의하셔야 합니다.

댓글목록

등록된 댓글이 없습니다.